THE INVESTMENT MAGAZINE – THE ORIGINAL – DAS INVESTMENT MAGAZIN – DAS ORIGINAL – Several Western financial institutions were holding Libyan state oil revenue last year, according to the nonprofit Global Witness, which cited a document it obtained.

The document names Goldman Sachs, HSBC Holdings, Societe Generale and several other institutions holding some of the sovereign wealth fund’s assets, which totaled more than $53 billion at the end of the second quarter of 2010, Global Witness said.

The Libyan sovereign wealth fund, as well as the national oil company, are now under international sanctions. Many of the national oil company’s subsidiaries are also under sanctions.

The document (pdf) is a summary of the Libyan Investment Authority’s investments created for the fund by KPMG and is dated June 30, 2010, according to the New York Times, which said it verified the document independently. The LIA wasn’t under sanctions at that time.

HSBC and Goldman Sachs are among the key western bankers for Colonel Gaddafi’s regime, a 2010 document leaked to Global Witness appears to show. The document details the whereabouts of state oil revenues. However the Libyan people could not know where it was invested or how much it was, because banks have no obligation to disclose state assets they hold. Global Witness is now calling for new laws requiring banks and investment funds to disclose all state funds that they manage.

Global Witness asked both banks to confirm that they held funds for the state-owned Libyan Investment Authority, and whether they still hold them. They both refused, with HSBC citing client confidentiality. Numerous other banks and financial firms are listed including Societe Generale, UniCredit and the Arab Banking Corporation.

“It is completely absurd that banks like HSBC and Goldman Sachs can hide behind customer confidentiality in a case like this. These are state accounts, so the customer is effectively the Libyan people and these banks are withholding vital information from them,” said Charmian Gooch, director of Global Witness.

The Gaddafi family has significant personal control over the state funds invested in the Libyan Investment Authority. According to the Prosecutor of the International Criminal Court, “Gaddafi makes no distinction between his personal assets and the resources of the country.”

On this basis, it is essential for banking regulators to investigate whether these banks have done enough to ensure that state funds have not been diverted to the Gaddafi family’s personal benefit.

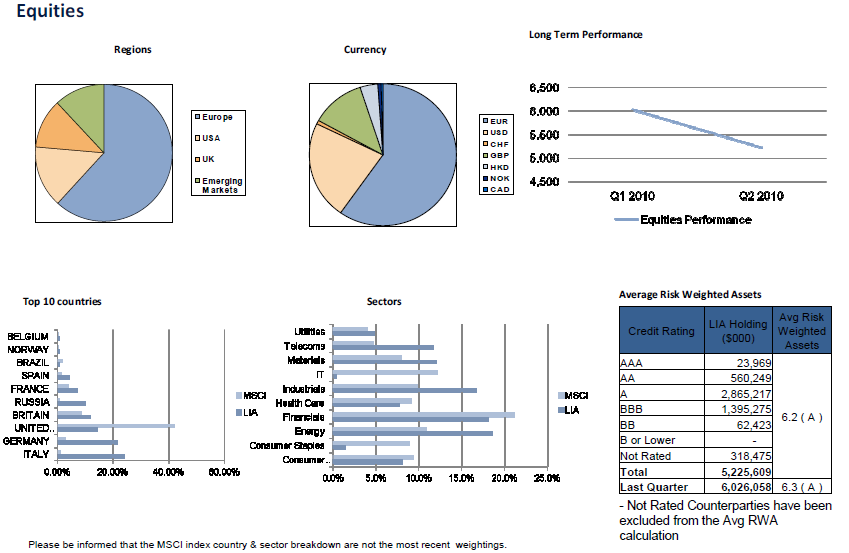

Global Witness has been leaked a draft presentation that appears to show the investment position for the Libyan Investment Authority (LIA) as of 30 June 2010, which stood at $53 billion. The information shows the diversity of Libyan assets held by major financial institutions:

HSBC holds $292.69 million across ten accounts and Goldman Sachs has $43 million in three accounts. The funds are in U.S. dollars, British pounds, Swiss Francs, Euros and Canadian dollars.

A much larger portion of the LIA’s deposits – $19 billion – are held in Libyan and Middle Eastern banks, including the Central Bank of Libya, the Arab Banking Corporation and the British Arab Commercial Bank.

Almost $4 billion of the LIA’s funds are held in structured products with banks, hedge funds and private firms such as Societe Generale ($1 billion), JP Morgan ($171 million) and OCH-ZIFF ($329 million).

The LIA owns billions of dollars of shares in household name companies such as General Electric, BP, Vivendi and Deutsche Telekom.

DOWNLOAD THE ORIGINAL DOCUMENT HERE

Reporting by Bernd Puzlch, Sarah Goodsmith, Bridget Gallagher and Tim Wilkinson